From penny-pinchers to spendthrifts, everybody may use a finances – and PTs aren’t any exception. Whether or not you need complete cash administration or a easy spreadsheet, the 4 budgeting apps listed under will enable you get monetary savings and curb spending.

Budgeting for PTs

Cash issues come up often on this weblog, as a result of monetary wellbeing is simply as related to a bodily therapist as bodily wellbeing. For those who throw your again out, you may’t do your job nicely – and in case your funds are tanking, your profession will endure.

PTs make an honest wage, however it comes with a catch: a number of 1000’s of {dollars}, generally six figures’ value, of PT college tuition. I knew I wanted a finances whereas I used to be in class, so I created this finances template to assist myself – and PT college students like me – keep away from mounting debt.

So should you’re a PT pupil struggling to pay tuition, or a licensed skilled working time beyond regulation to remain within the black, it’s best to take into account budgeting. It’s among the finest issues you are able to do in your funds, and now with the plethora of apps and spreadsheets accessible on-line, it’s by no means been simpler.

4 Finest Budgeting Apps

Budgeting could be overwhelming by itself, so don’t get slowed down trying to find the perfect budgeting apps. Under are my high picks for 2022!

Every day Price range: Finest for the Minimalist

Options:

- Price range calculation

- Expense categorization

- Saving for objectives and funds

Worth:

- Free for normal model

Execs:

- Simple to make use of and nice for on-the-go monitoring

- Categorization is elective

- Information could be simply backed as much as the cloud

Cons:

- Doesn’t hyperlink to exterior accounts or banks

- Requires guide entry

- Doesn’t accommodate a number of units or associate budgeting

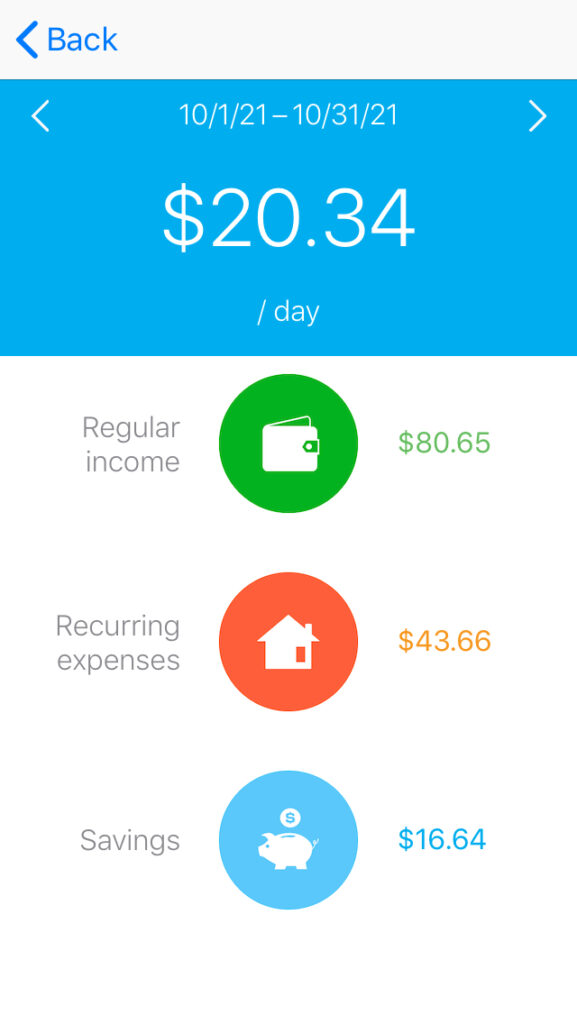

Budgeting doesn’t must be difficult. All of it comes down to at least one precept: spend lower than you make. Every day Price range calculates how a lot you may spend every day by deducting all of your common bills and payments out of your revenue.

As an example, if I make $3000 every month and finances $2100 of it for financial savings and payments, I’ll have $900 leftover for versatile or variable spending, resembling purchasing, groceries, and consuming out.

As a substitute of getting me categorize and monitor that $900, Every day Price range merely divides it by the variety of days in a month: $30. That’s how a lot I may spend every day and be inside my finances.

This idea is just like the envelope methodology, the place you solely spend money from an appointed envelope. For those who spend lower than your day by day allowance ($30, in my case), the leftover cash rolls over. For those who overspend, you’ll have a destructive steadiness till your accruing allowances put you out of the outlet.

Every day Price range is ideal for individuals who don’t need to file each single greenback right into a class or job. For those who’re into that sort of factor, the app does permit you to categorize your bills, however you’re not required to.

Usability

The app is astoundingly easy to make use of. It may accommodate a wide range of revenue conditions, whether or not you’re paid weekly, month-to-month, yearly, or at random. Equally, your mounted bills replicate your yr’s bills (together with these sneaky subscriptions you overlook about), and you may at all times regulate these quantities.

Identical to different budgeting apps, DB might help you propose for financial savings objectives or contribute to specific funds. If there’s an enormous expense you’d like to save lots of up for, you may set it up as a “Massive expense,” which, just like the mounted bills, will probably be deducted out of your day by day finances till you could have saved the steadiness.

Worth

The usual model of Every day Price range is free to make use of. For a one-time fee of $11.99, the PRO model provides extra classes, advert elimination, and tighter knowledge safety. However as a result of neither model includes linking to a checking account, there’s little private knowledge to danger.

EveryDollar: Finest for the Autonomous Budgeter

Options:

- Zero-dollar finances calculation

- Customizable categorization

- Financial savings objectives and funds

Worth:

- Free for normal model

Execs:

- Helps a fundamental method to budgeting

- Depicts month-to-month spending with charts and comparisons

- Free to make use of (normal model) with few adverts

Cons:

- Doesn’t hyperlink financial institution accounts

- Requires guide entry and maintenance

The most effective-known budgeting apps, EveryDollar is the brainchild of Private Finance guru Dave Ramsey (well-known for the aforementioned envelope methodology).

With this app, you’ll assign a spending class to each final greenback of your revenue, from main classes resembling Well being and Housing to specific classes you customise every month.

It isn’t riddled with bells and whistles, however it does show month-to-month pie charts and spending percentages. The app will even retain information of earlier months’ budgets, making it straightforward so that you can examine your spending from the earlier yr.

With EveryDollar, you may arrange all of your cash, together with what you set in direction of debt or stash away in a fund. An Emergency Fund is inbuilt to each month’s finances, which shouldn’t come as a shock should you’ve learn something by Dave Ramsey (resembling Complete Cash Makeover).

Usability

You’ll be able to entry your EveryDollar finances on each your cellphone and your laptop, so it’s straightforward to share the account with one other system resembling a associate’s cellphone. Organising your classes and monitoring your spending are intuitive and straightforward irrespective of the system you utilize.

The one downside to utilizing the app is getting by way of the persistent adverts for Ramsey+, a paid improve. In any other case, there aren’t any different adverts to distract you out of your private finance progress.

Worth

EveryDollar is free to make use of, however if you would like the total budgeting options of financial institution synchronization and Ramsey sources, you’ll have to pay a (relatively hefty) subscription to Ramsey+. A yr’s value prices $130, whereas a 6-month subscription is $100 and a 3-month subscription $60.

YNAB: Finest for the Budgeting Newbie

Options:

- Price range calculation

- Hyperlinks exterior accounts and banks

- Tracks and analyzes spending

Worth:

Execs:

- Instructional emphasis for behavioral change

- Contains entry to free workshops every month

- Constructed for a number of units and joined accounts

Cons:

- Requires a subscription

- Restricted to budgeting; no different finance capabilities

For those who’re at all times taking part in “catch-up” along with your funds, YNAB can present you a brand new manner. As a substitute of budgeting future cash for current bills, you’ll discover ways to finances current cash for future bills. You Want A Price range focuses solely on budgeting: the place your cash will go and what you’ll have left to save lots of and spend.

However don’t let its easy premise underwhelm you; the app isn’t restricted to monitoring transactions and assigning classes like EveryDollar is. Utilizing 4 ideas of life-style budgeting, the YNAB app guides customers into creating techniques and habits that transfer, breathe, and replicate real-life bills. It provides a extra nuanced method than Every day Price range, with comparable ease of use.

Usability

All good change requires changes, and it could take you just a few weeks to get the dangle of utilizing YNAB. Though there are various options to discover and implement, YNAB retains it easy for you with clear directions and shortcuts.

One of many hardest issues about sticking to a finances is maintaining with the “paperwork” – inputting each final expense into your app or spreadsheet. To expedite the method, YNAB hyperlinks to your financial institution accounts and routinely information your transactions. And also you’ll get pleasure from reviewing the resultant spending studies, bejeweled with colourful charts and graphs.

Worth

YNAB’s distinctive method to behavioral budgeting is profoundly efficient, however these advantages come at a value. After a free 34-day trial, you’ll must pay a subscription for YNAB, both $12 month-to-month or $84 yearly.

Put in perspective, it is a small value to pay for the immense return on funding you’ll probably make, contemplating the typical person saves $600 annually. For those who keep on with this system, these charges can pay for themselves in {dollars} saved.

Mint: Finest Free Budgeting App

- Options:

- Price range calculation and categorization; hyperlinks banks

- Contains financial savings objectives and provides sensible teaching

- Displays investments, invoice funds, and credit score report

Worth:

Execs:

- Extremely safe and straightforward to make use of

- Free with all options included

- Tracks investments

- Runs quarterly credit score studies

Cons:

- No choice to hitch Mint accounts for associate budgeting

- No technique to eliminate adverts

Contemplating it’s the #1 most downloaded private finance app, there’s a great probability you already learn about Mint. I’ve used it for my private funds since 2008, and I can attest that Mint is common for good motive.

A veritable all-in-one private finance bundle, Mint is greater than a budgeting app. Apart from linking all of your accounts and monitoring your transactions, Mint provides some options past what you’d get from their rivals.

For instance, Mint runs quarterly credit score studies by way of TransUnion and can provide you with a warning to any modifications in your credit score rating.

Many budgeting apps permit you to create monetary objectives, however Mint takes it a step additional. By surveying your subscriptions and analyzing your spending, Mint will present you the place to chop again should you’re lagging behind your objectives.

Many customers just like the “This Month” tab, which shows in a single calendar web page all of your upcoming payments, of which you’ll select to be notified.

Whereas Mint isn’t an funding app, it will possibly additionally enable you monitor your investments by synchronizing your IRA, 401(okay) and different fund accounts. Your funding charges are a part of your bills and belong in your finances, however few budgeting apps accommodate investments like Mint does.

Usability

Regardless of its complexity, Mint is simple to make use of. For those who’ve ever operated QuickBooks or TurboTax, you already understand how user-friendly Intuit software program could be.

And identical to different Intuit apps, Mint options air-tight knowledge safety: multiple-factor authentication, sturdy encryption, and an elective 4-digit passcode. Plus, with distant entry you may simply shut out your account from one other system, defending your financial institution info within the occasion of a misplaced or stolen cellphone.

It could take you just a few weeks to get snug utilizing the app, particularly should you’ve by no means budgeted earlier than, however in the end I believe you’ll discover these options are well worth the studying curve.

Worth

Maybe one of many best attracts to the Mint budgeting app is its affordability. Not solely is Mint free to make use of – sure, completely free – there isn’t a “free model” and “paid model.” All options, from credit score monitoring to financial institution syncing to funding monitoring, can be found free of charge.

The one catch to this nonexistent price ticket is the presence of adverts. In-app ads generate income for Mint and allow the app to be free. Nonetheless, as a result of there’s no paid model (at the least, on the time of this writing), you may’t eliminate these adverts, even should you’re keen to pay.

Budgeting Bonus: Downloadable finances spreadsheet

Not everyone seems to be tech-savvy, and I do know loads of PTs preferring pen-and-paper strategies. Simply because these budgeting apps are broadly efficient doesn’t imply you may’t obtain comparable outcomes with a easy spreadsheet. To get began by yourself finances spreadsheet, try this free, printable finances plan from an incredible private finance weblog.

Finally, none of those instruments will enhance your funds on their very own, and there’s no true “set-it-and-forget-it” finances. It’d take you many months to ascertain the self-discipline of budgeting, however your efforts will repay ultimately.